The following Case Studies represent the first three platform investments made through a closed-end fund by the team while at Berkshire Group, but do not include all of the investments. Broadview currently acts as a sub-advisor to that Berkshire fund.

LCB Senior Living

Background

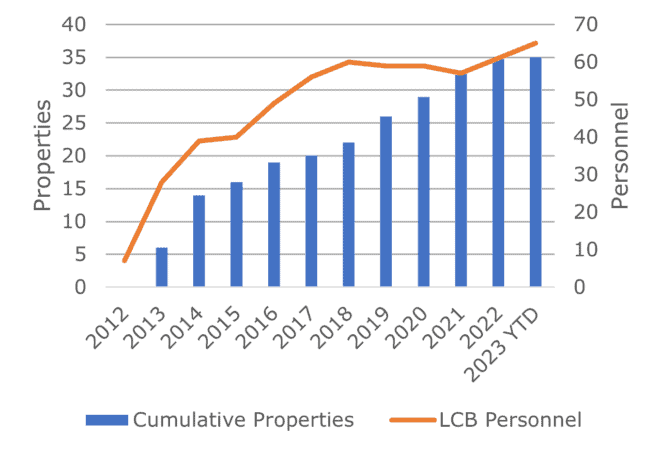

- Introduced to LCB in 2012, closed entity level transaction in 2013 (LCB Berkshire)

- LCB principals had prior senior housing experience

- Started with core group of seven employees, two managed assets

- Opportunity to build top-tier operating company and capitalize on favorable development yields in attractive northeast markets

Value Add

- Provide entity-level capital to grow the organization and increase its senior housing development and acquisitions volume

- Offer strategic direction by helping formulate plan for investment strategy, key underwriting criteria and capital markets approach

- Advise on organizational build-out

- Incorporate institutional best practices into investment committee process, development risk mitigation, and reporting to investors

- Advise on negotiations with potential LP equity partners and lenders to optimize terms

- Capital investment allows for higher GP co-invest, which can facilitate better terms with LP equity partners and lenders

- Provide growth capital for corporate overhead, pursuit costs and support for guarantees to lenders

Platform Status

- Closed 38 senior housing acquisitions and development projects totaling over $1.5 billion in cost

- Expanded company’s reach from New England to the Mid-Atlantic region and NYC metro area

- Have grown LCB team to more than 60 corporate employees and approximately 2500 property level management company employees

- LCB Berkshire has realized 14 investments producing returns above original underwriting.

Residence at Penniman Hill | Hingham, MA | 90 Units

Residence at Penniman Hill | Hingham, MA | 90 Units

Source: Broadview, LCB Senior Living

Lodging Capital Partners

Background

- Prior relationship with LCP team; closed platform (LCP Berkshire) in early 2011

- LCP principals had prior lodging sector experience

- Opportunity to invest in the hotel sector in 2011, difficult capital environment for cyclical assets

Value Add

- Provided GP capital to support hotel acquisitions strategy

- Incorporated institutional best practices into investment committee process and reporting to investors

- Vetted pipeline investments on a weekly basis, reviewed underwriting, and approved all platform investments

- Improved terms with LP equity partners by bringing institutional knowledge into JV negotiations and introduced new LP relationships

- Provided growth capital for corporate overhead, pursuit costs, and support for guarantees to lenders

Platform Status

- Acquired nine hotels with a total capitalization of over $700 million between 2011 and 2014

- LCP Berkshire has realized nine investments producing returns above original underwriting

Four Seasons Hotel | Austin, TX | 291 Rooms

Four Seasons Hotel | Austin, TX | 291 Rooms Hilton | Portland, OR | 782 Rooms

Hilton | Portland, OR | 782 RoomsStrategic Capital Partners

Background

- Introduced to SCP in early 2015 and closed venture in late 2015 (Berkshire SCP)

- SCP principals had prior office and industrial experience as senior executives at Duke Realty and wanted to increase investment capacity

- Opportunity to acquire and develop office and industrial properties in secondary and tertiary markets in the Southeast, Mid-Atlantic and Midwest

Value Add

- Provide programmatic GP capital to support a greater volume of new investments

- Vet pipeline investments on a weekly basis, review underwriting, and ensure consistency and marketability

- Assist with project due diligence where applicable

- Improve terms with LP equity partners by bringing institutional knowledge into negotiations and introduced new LP relationships

- Provide capital for pursuit costs and pre-development

- Provided LP capital for one industrial warehouse development project

Platform Status

- Closed 13 industrial warehouse development deals representing a total of approximately 8.4 million square feet of space

- Closed 5 office acquisition and development deals representing a total of over 2.8 million square feet of office space

The investments and/or case studies referred to above are for illustration purposes only. The investments and partnerships included herein may not be similar to those of any contemplated future fund, vehicle or partnership and it should not be assumed that any similar or future investments will achieve comparable results. The information in the three case studies above is presented as of March 31, 2023 and is subject to change.

Midway 840 | Nashville, TN | 633,000 SF

Midway 840 | Nashville, TN | 633,000 SF Springdale Commerce Park | Cincinnati, OH | 577,000 SF

Springdale Commerce Park | Cincinnati, OH | 577,000 SF